“What You Have to Believe” Sensitivity

The sensitivity I created below sensitizes end of year S&P 500 (SPX) targets and recession probability to estimate a hypothetical fair value for the S&P 500. Using the end of year average base case target from Goldman Sachs and Morgan Stanley combined with recession odds from Polymarket/Kalshi, the current fair value of SPX is 5,125. At the moment, anything in that yellow zone could make sense to me, but the current situation is highly fluid. For me the most challenging target is the “bull case level”. I can’t see the S&P 500 ending the year above 6,100 at this point, however many investment banks still have targets well above this level therefore I’ve tried to remain somewhat optimistic.

4-Hour DeMark Price Charts with Gamma Support/Resistance Levels ($SPY, $QQQ)

If you’re looking for key price levels that may act as support or resistance, check out the charts below, which are based on Friday’s largest option open interest levels.

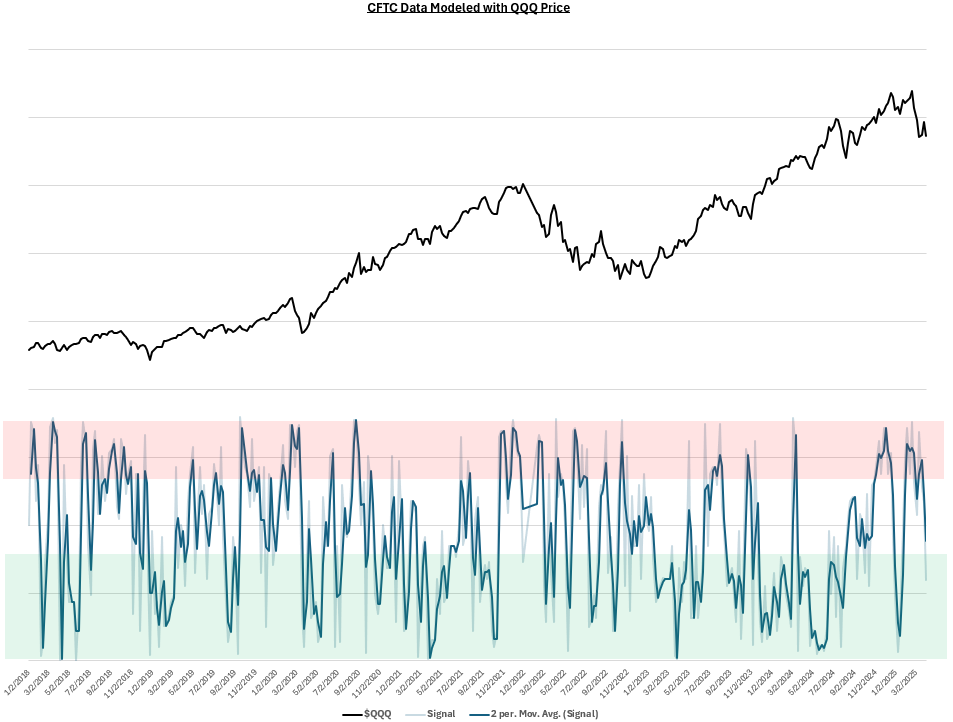

CFTC Positioning

The CFTC Nasdaq positioning model I shared previously has finally improved a bit and is now almost in the green zone. Keep in mind this data is as of Tuesday (released Fridays) so my guess is that next Friday’s data will get this model into the green zone, assuming the improvement trend continues. I built this model fairly recently and it looks at historical price outcomes based on the CFTC positioning of different investor types. It appears to backtest “okay” given the chart, but unclear if it will continue to work in real life. It has been performed very well since I started sharing it earlier this year. My skepticism is mainly driven by the fact that the math is fairly simple, and the data is free.

Here is the chart for IWM 0.00%↑ using the same methodology. CTAs are most short Russell as it may perform the worst until it’s clear the business cycle has shifted to “early” from “late”. Key sign to look for is the Fed reducing rates. However, not sure if this sign will work the same if Trump fires Powell and replaces him with a “yes man”. If this happens, I think all assets continue to fall. Trump flipped back to being critical of Powell Friday and is well known to break well-established rules to replace key leadership positions.

Keep reading with a 7-day free trial

Subscribe to The Data-Driven Investor to keep reading this post and get 7 days of free access to the full post archives.