Tech's Bad Week Continues.

This week started off with a breakdown of the Mags 7 wedge.

Literally every day since 2025 started, I’ve stated:

“I’m still expecting a 200 DMA test ($570 SPY at a minimum) this year to get some really good dip buys in (literally a gut feeling based on sentiment data and the fact we haven’t tested the 200 DMA in a long time). I’m thinking by April OPEX there is a really good equity dip buy opportunity. Always a chance I’m wrong, so I never have no exposure to equities. My plan is to ride longs with occasional VIX futures exposure to manage downside risk.”

Ideally, the plan was to predict the path to $570 perfectly, but the tariff man has thrown a few wretches into this plan. Today, for the second time this year I was riding longs until my 5 TD model flipped to a more bearish stance and along comes another intraday tariff bomb wrecking my position. If you’re finding it difficult to ride short term longs you’re not alone. I think longs will require more patience this year and will be substantially riskier than the past 2 years. As I said in my 2025 outlook shared in December, I expect this year to be down double digits, and it will be led by tech. I have seen nothing that makes me think differently thus far.

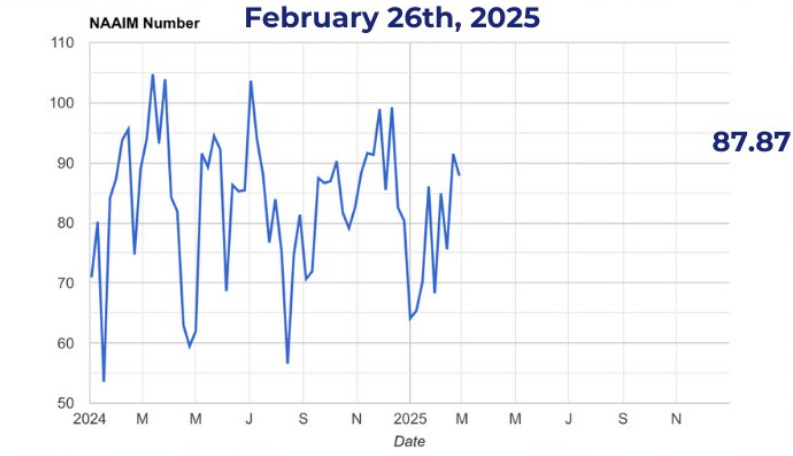

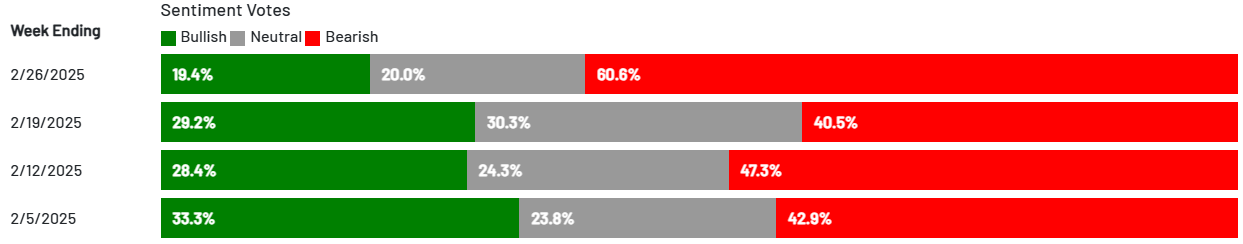

You may be thinking, “wow, everyone must have sold this week”. Turns out that’s far from the truth. NAAIM asset manager equity exposure was released today showing asset managers are still very long this market.

Maybe you also saw that AAII folks are bearish. First of all, 71% of AAII is retired and their average portfolio size if $1.8M. I wouldn’t say this group represents retail well. Do you want to know what retail was doing the past week? According the JPM’s Retail Radar report they were loading up on semis, NVDA 0.00%↑ (huge net buying, over $1B) and AMD 0.00%↑ . The good times are priced into semis, the highs were last year. They ain’t coming back.

I digress, back to AAII, their sentiment for whatever reason has deviated from their allocations in recent years. At the end of January this group of mostly retirees was 69% long stocks! The last time they were this bearish was September 2022 and before that? March 2009. Following that September 2022 bearish sentiment reading they were holding a 62% equity allocation and in March 2009 a mere 41%. These sentiment polls are meaningless unless the folks taking them are actually adjusting their allocations to reflect their beliefs. In my opinion, a 69% stock allocation is a no fear allocation for a retiree.

Back to semis, it looks like we will get the 50 DMA crossing through the 200 DMA sometime next week. This is historically a bad omen for tech.

At the end of 2021, we had the same pattern we’ve had the last 4 months; a sideways channel that collects all the dips buyers before a break. In 2022, the channel from late 2021 broke to the downside and it wasn’t a great year.

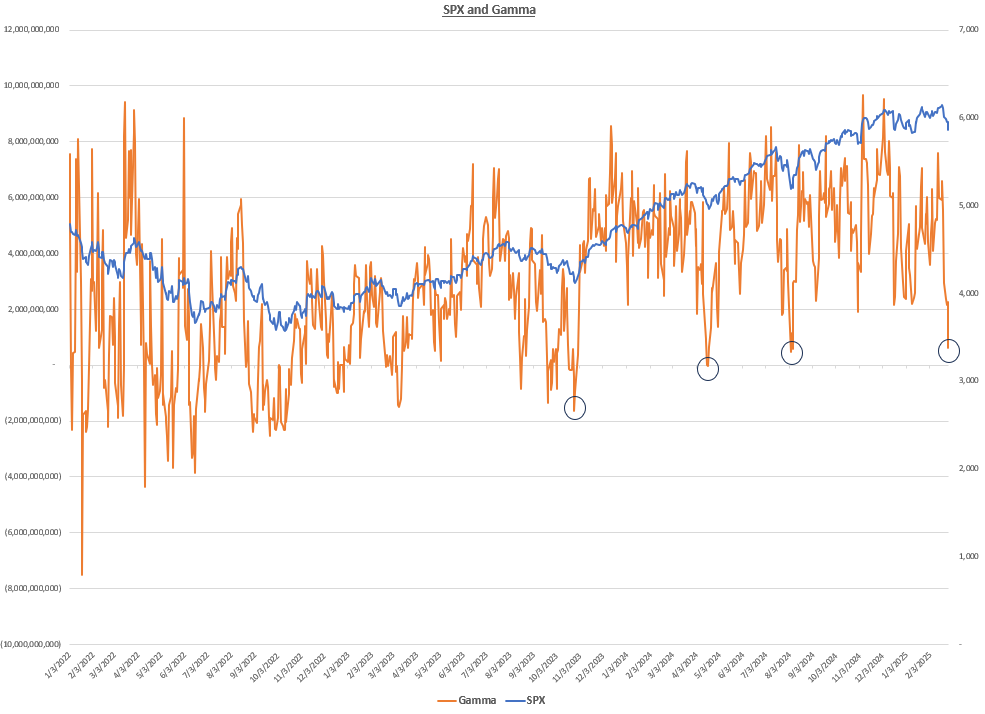

On the plus side, based on where gamma ended today, markets have historically bounced. Of course, this time could be different, and it’s possible it actually is given the level of uncertainty from this new administration.