I’d argue the Mag 7 wedge outcome makes the chart below the most important chart in the world. As we approach NVDA 0.00%↑ earnings next week and OPEX passes tomorrow, we will get more clues as to the direction of the break. Given how much room is left on it, I’m thinking get the move by next Friday at the latest. The sustained move in Chinese and EU stocks does make me wonder if Japanese and Chinese investors start to shift their fast money from Mag 7 to unloved international investments (definitely seeing it YTD).

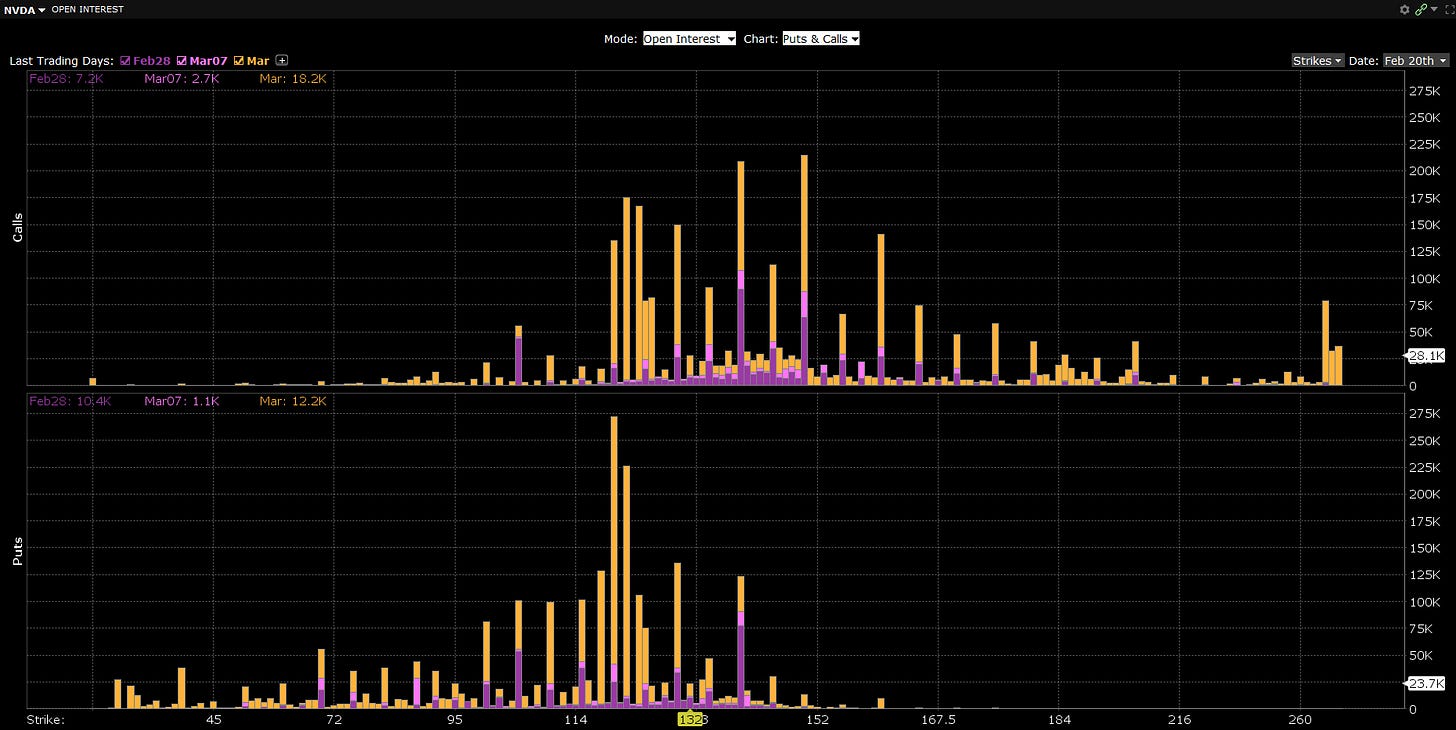

On $NVDA, open interest implied move is $120-150. Maybe a case could be made for $160, but typically you don’t see those OTM calls beyond where puts level off get hit so I’m ignoring it.

PLEASE READ: The tables below are what I use to time long-term buys (e.g. retirement funds). I always maximize my equity allocation when the market enters the dark green zone (the bottom of “Lower Risk”), but those opportunities only come around a few times a year. Buying equities in the light green zone is a good option as well because it’s better to put money to work sooner rather than later. The red zone is “Higher Risk” and can often lead to immediate losses, so I never buy equities when the blue signal line is in the red zone (typically reallocating from stocks to bonds here). I never go short in my long-term portfolio because stocks go up more than 50% of the time and when they do go down, they don’t tend to stay down for very long (i.e. shorting is hard).

S&P 500 15 Trading Day Model and Related Data (Explanations are in the Appendix)

QQQ equal weight index is overbought which in the past has presented challenges for the QQQs *if* Mag 7 strength doesn’t level up here. So far, it’s causing a challenge as we saw a pullback today.

Keep reading with a 7-day free trial

Subscribe to The Data-Driven Investor to keep reading this post and get 7 days of free access to the full post archives.