The S&P 500 fell 0.3% today as tech stocks faded today as the non-stop rally appears to be running out of steam. Meta’s stock fell 3% after hours and tech giant Microsoft fell 4% as guidance disappointed. Tomorrow after the close is Apple, Intel, and Amazon then Friday begins with Exxon and Chevron. Even with lowered expectations, it appears some companies are struggling to get investors excited about current valuations. What would help equity prices is interest rates declining, better earnings guidance from other large caps, and/or the election getting into the rear-view mirror without any significant issues.

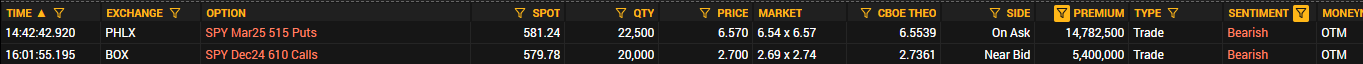

Looking at option open interest through November OPEX for SPY and QQQ, there is not much call OI gas in the tank to drive stocks higher by November OPEX with $590 resistance for SPY 0.00%↑ and $510 for QQQ 0.00%↑. Typically, these large call positions are built on pullbacks so it’s likely we reach those upper thresholds then fallback before additional call positions are opened up. Going out to December for SPY, $615 seems to be popular target with whales buying that strike recently.

SPY and QQQ Open Interest Through November OPEX as of 10/28/2024

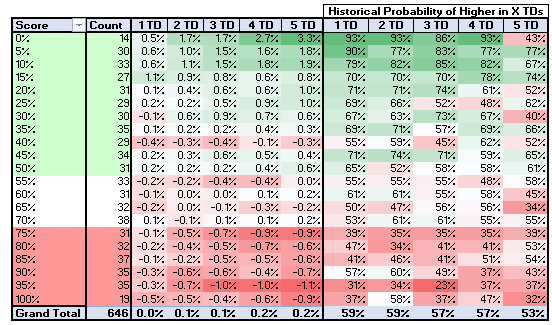

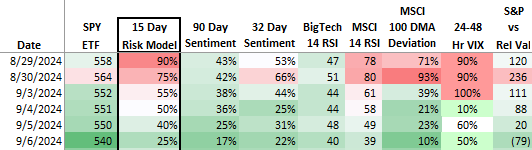

The S&P 500 5 trading day (TD) option model is neutral at 55% and the VIX model is slightly bearish on volatility at 40%. I put the historical probability table below as a reference. During bull markets declines don’t last long and vice versa.

S&P 500 5 TD Option Based Risk Model

PLEASE READ: Risk model scores: Red is bearish, green is bullish, anything else is neutral.

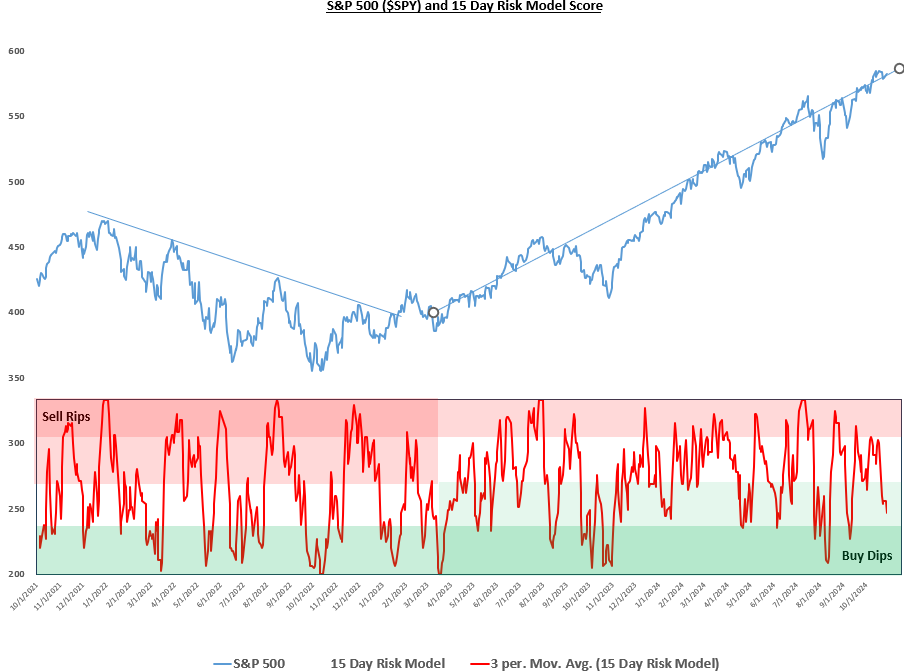

PLEASE READ: The tables below are what I use to time long-term buys (e.g. retirement funds). I always maximize my equity allocation when the market enters the dark green zone (the bottom of “Lower Risk”), but those opportunities only come around a few times a year. Buying equities in the light green zone is a good option as well because it’s better to put money to work sooner rather than later. The red zone is “Higher Risk” and can often lead to immediate losses, so I never buy equities when the blue signal line is in the red zone (typically reallocating from stocks to bonds here). I never go short in my long-term portfolio because stocks go up more than 50% of the time and when they do go down, they don’t tend to stay down for very long (i.e. shorting is hard).

The OG Models as of 10/28/2024 (Explanations are in the Appendix)

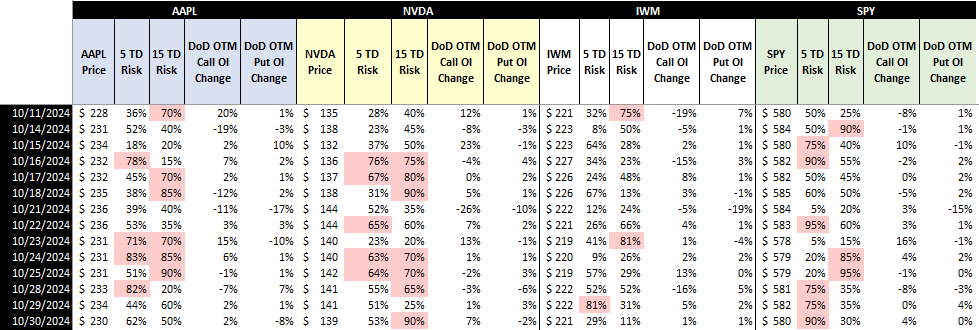

5 & 15 TD Risk Model Summaries

PLEASE READ: If the color coding is red, then historically the related symbol has averaged negative returns at that score, otherwise it has averaged positive returns (lower the score the more bullish it is). The change in day-over-day OTM option data is just a “nice to know”.

PLEASE READ: The tables below show how my own Nvidia, Apple, and Tesla models, which are based on option flows, are looking over the next 15 trading days (TDs). The red signal line location typically points to sustainable large moves 15 TDs out while the blue line tends to point to more short-term moves.

NVDA Price and 15 TD Risk Model Signal (Graph is Based on Tables Above)

TSLA Price and 15 Day Risk Model Signal (Graph is Based on Tables Above)

I deleted underperforming TSLA models this weekend since I didn’t like the performance of the outputs following the last two major events. Hopefully performance is better going forward.

AAPL Price and 15 Day Risk Model Signal (Graph is Based on Tables Above)

October Seasonality

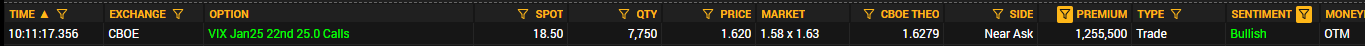

Large OTM Option Trades of the Day:

Summary: The SPY 5 TD model has been bearish the past 3 TDs, but the 5 TD model, which is a combination of all of the option models has been neutral to slightly bullish while the VIX model has not been bullish on volatility. On top of this, the OG 15 TD model is not bearish so overall still believe dips are bought and stocks head higher.

Disclaimer

This document does not contain financial advice, and it is provided for entertainment purposes only. The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The performance represented throughout this document is historical and past performance is not a reliable indicator of future results. The author cannot be held responsible for your use of the information contained in this document. The author also assumes no responsibility or liability for any errors or omissions in the content of this document. The information is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness. All content within this document is the property of SPYSTSignals, LLC unless otherwise stated. All rights reserved. No part of this document may be reproduced, transmitted or copied in any form or by any means without the prior written consent of SPYSTSignals, LLC.

Appendixes

How My Models Work [This Section is Appended to the Bottom of All Newsletters]

Starting from the left of the table below:

SPY ETF: SPY is the ticker for the largest S&P 500 ETF and the value is the closing price as of the date shown.

15 Day Risk Model: This model is made up of ~25 different models that are built on different market metrics (e.g. breadth, price, relative valuation, sentiment, gamma, etc.). Each model looks at the metric for the date shown, finds a historical match, and serves up the historic median return for the S&P 500 15 trading days later. These values are then ranked across historical values to determine a score from 0-100%. 100% is max bearish and vice versa. More info to be provided in the “How I Use My Models” section.

15 Day Signal: The signal is based on the 15 Day Risk Model chart, which uses a 3 day average of the 15 Day Risk Model Score to determine the signal. There is only “Long” and “Cash”, given that I always dedicate more money towards being long. If it’s “Long” than I always have a long position in addition to the position in my short-term account. If it’s “Cash”, then the short-term account is my only position.

90 Day Sentiment: This is a “nice to know” indicator. It looks at sentiment across select metrics related to the markets (e.g. ISEE, NAAIM, CFTC data, etc.) and simply ranks them over 90 days.

32 Day Sentiment: This is a “nice to know” indicator. It looks at sentiment across select metrics related to the markets (e.g. ISEE, NAAIM, P/C ratios, etc.) and simply ranks them over 32 days. Compared to 90 Day Sentiment, it also uses less delayed metrics (e.g. CFTC data).

Big Tech 14 RSI: This is a “nice to know” indicator. It is the 14 day relative strength index of Apple, Microsoft, Amazon, Google, Tesla, Facebook/Meta, and Nvidia combined.

MSCI 14 RSI: This is a “nice to know” indicator. It is the 14 day relative strength index of the iShares MSCI ACWI ETF which tracks an index composed of large and mid-capitalization developed and emerging market equities. It provides a world-wide view of strength in equities.

S&P 500 Relative Value: This is the output of a relative value model I created for the S&P 500. It looks at the value of the S&P relative to other assets (over 100 days), in this case 10-year treasuries, junk bonds, and the US Dollar. For instance, if the market is trading far above the S&P 500 Relative Value then it is possible that stocks have got ahead of themselves given the 10-year is used to discount earnings, a stronger dollar negatively impacts earnings of US global companies, and junk bonds trading down can imply a higher level of economic risk.

Daily Model Output Example

How I Use My Models

I began developing these models in 2018 to manage my retirement portfolio and a taxable account I use for short-term active trading. I generally trade futures because the data for my models is not available until after the market close.

The 15 Day Risk Model chart is what I typically use to manage my retirement funds. It’s rare that the model reaches 100% and the chart peaks into the red zone, but when it does, I sell equities and move to cash or bonds. I buy equities back and put new money to work the chart enters the Add Risk zone. I never go short in my retirement account because identifying when to sell the market is more difficult than identifying when to buy the market (statistically speaking) so if I’m going to be wrong then it’s more likely to happen on the short side.

When everything in between the Risk Model columns in Table 1 is green, I tend to be on the lookout for bottoms/bounces (and vice versa). If the market is going to bounce, then there should be three or more buy signals coming from the 15 Day Risk Model (and vice versa). Occasionally one signal going in the opposite direction of the others will fall into the 15 Day Risk Model. I ignore these if there are not three or more OR if the signal that has been coming up most often comes back.

The 15 Day Risk Model color coding in the table can differ in bull and bear markets. In bull markets, an 80% signal is often not strong enough to warrant a sell signal, but in bear markets it is enough. This can make signal reading outside of extreme readings difficult, especially around regime changes (bear that turns into bull and vice versa). I’ve added historical probabilities below to highlight how this model has historically performed at different scores and regimes.

15 Day Risk Model Performance by Score in Bull and Bear Markets

The 5 Day Risk Model is what I use to manage my short-term account where I go long and short futures. I trade the values that have the highest historical probabilities (exception is when there are option whale insights and/or VIX model insights that give me additional confidence). I don’t trade often, I have a long bias, and I don’t love options. I always focus on risk management, keeping positions small, assuming that I will win over the long run. It makes trading quite boring, but it also keeps me in the game. If you find trading exciting, you’re probably taking on too much risk. I’ve traded full time, and it is 100% the most boring job I’ve ever had.

You’ll often hear me reference index option whale activity and my VIX model. I have many models that look at index option activity in different ways to understand what large funds are doing. These models feed into my risk models, but since each model is equal weighted, their outputs can sometimes get offset. Since these models are my most accurate models, I often review the outputs separately to ensure I do not miss an insight.

Lastly, I use my VIX model to determine volatility (vol) strength, along with seasonality charts. Table 4 highlights vol returns given VIX model scores for the past 2 years (also includes 2018 and 2020 vol spikes). This model looks at how investors are positioned in the VIX in an effort to gauge the likelihood of vol moving higher or lower.

24-48 Hr VIX: Column shows current VIX Score for the VIX model.

VIX Model Historical Returns and Probabilities

Do you still expect Q to reach 510 in Nov opex? The sell off of Q was quite strong, is because Japan interest rate decision? Will that like August sell off?

Whenever we see consolidation for so many days and not able to breakout then we get a sharp sell off lasting 3-4 days